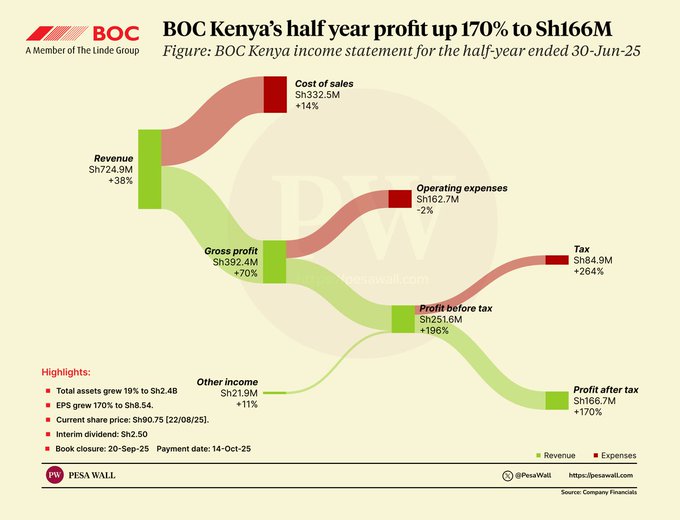

BOC Kenya half year profits grew 170% to Sh166 million. —Revenue: +38% to 725M —Profit after tax: +170% to 166.7M —Earnings per share: +170% to Sh8.54 —Interim dividend: Sh2.50

BOC Kenya half year earnings rise 170% to Sh166M on higher revenue

BOC Kenya has posted a 170 per cent rise in profits to Sh166 million for the six month period ending June 2025 due to higher revenue.

PWBy: Ian

IN BRIEF:

- Revenue: +38% to Sh725M.

- Gross Profit: +70% to Sh392M.

- Profit Before Tax: +85% to Sh251M.

- Profit: +170% to Sh166M.

- Earnings per share: +170% to Sh8.54.

- Interim Dividend: Sh2.50.

Medical gases manufacturer, BOC Kenya, has reported a 170 per cent rise in profit after tax to Sh166 million for the six months to June 2025 from Sh61 million posted last year . This was largely driven by increased demand for medical and industrial gases and customer engineering projects that saw revenue increase by 38 per cent to Sh725 million, from Sh523 million a year prior.

Distribution, selling and administration expenses fell 1.8% from Sh165 million to Sh162 million due to management interventions to reduce costs.

The company has also had an opportunity to adjust its pricing as last year’s tenders come to an end, allow it to revise its pricing in line with increased costs.

“A pricing benefit is being realized in 2025 as various 2024 tenders come to an end, allowing the company to adjust its pricing to account for increased overhead,” The company said in the commentary section accompanying the interim results.

The company has retained its interim dividend at Sh2.50 per share, to be paid on or about 14th October 2025 to shareholders on the register at the close of business on 20th September 2025.

The company expects minimal change in performance in the second half of the year, as all engineering projects are likely to be completed before year-end.

Explore more on these topics

More from News

EQUITY DEALS3mins ago

Government to sell 15% stake in Safaricom for Sh204.3bn

The government has entered into an agreement with Vodafone Kenya to sell its 15 per cent stake in Safaricom and future Safaricom dividends amounting to Sh55.7 billion for Sh244.5 billion.

FUNDING17mins ago

Safaricom targets Sh15bn from corporate bond

Safaricom is set to raise up to Sh20 billion in the first tranche of its Sh40 billion medium-term note programme, offering investors an annual interest rate of 10.4 per cent.